Many of the biggest tech companies today might’ve failed without venture capital. Apple, Google, Microsoft – all of them relied on venture capital when they were starting out.

While banks typically won’t loan money to startups because of their lack of solid financials and past history, venture capitalists look to the future. They invest in high-risk startups because of their potential to make massive returns.

For example, Accel Partners was set to make a 1,000x return from its investment in Facebook. The VC firm invested US$12.7 million in the company in 2005, and its stake was worth US$9 billion just prior to Facebook’s IPO (it sold off some of its shares before that).

Who do venture capitalists invest in?

Venture capital is a type of financial capital supplied to startups (read: what is a startup?). Venture capital (VC) firms invest a sum of money – typically in the millions – in these companies in exchange for equity.

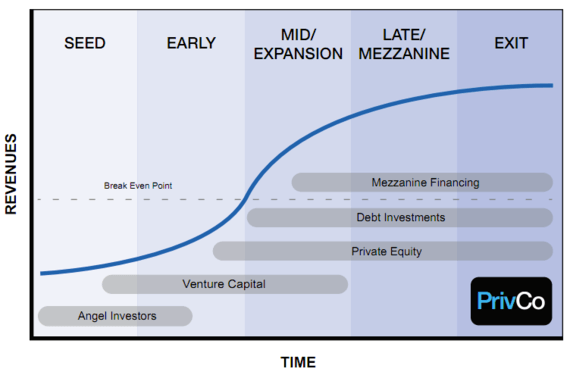

Investors can exit, in other words, cash out after a startup gets acquired or lists on a stock market. They’ll often sell their shares before an acquisition or public listing in order to de-risk, or if they believe they’ve met their investment objectives.

Venture capital investments are risky because of the high failure rate of startups. However, these firms bank on finding outlier startups (like Facebook) which can generate returns on investment big enough to make up for losses from other investments.

Venture capital firms have a portfolio consisting of multiple startups at any one time. They may operate multiple funds focusing on different industries or geographical regions.

VC firms tend to fund startups that have been validated by the market and show potential for rapid growth. These startups would have secured a small but fast-increasing user base, and are in need of money for scaling infrastructure, adding product features, as well as investing in sales and marketing. Sometimes, venture capitalists will invest in companies with unreleased products, as Andreessen Horowitz did in Magic Leap.

How do they invest?

Image credit: PrivCo.

Startups seek out seed funding from angel investors first before looking at venture capital. The first round of VC funding is typically called a series A round, with subsequent rounds denoted as series B, series C, and so on (see: stages of a startup). Some venture capital firms, however, do invest in seed rounds.

VC firms often invest as a syndicate. In other words, multiple firms may invest in a startup in the same round, although one firm will be a lead investor.

Lead investors are the ones who have done most of the due diligence on the startup, and are probably also the ones responsible for putting together the syndicate and crafting the terms of the deal.

Once a term sheet is signed by the startup, the venture capital firm will conduct due diligence on the investee. The due diligence process, or “due-D”, typically consists of background checks on founders, verification of sales and traction numbers, and checking of any potential legal minefields. The goal is to get a more accurate assessment of the investment risk.

Venture capital firms can pull out even after a term sheet is signed if they find something amiss in the startup. Term sheets by-and-large are non legally binding. The deal is only done when the money is in the bank.

How are venture capital firms run?

VC firms are run by a team who manage capital supplied by limited partners (LPs). LPs can be institutional investors, wealthy individuals, or corporations. These firms fund their operations by taking a management fee.

At the top of the hierarchy in VC firms are the managing partners who make the call on which companies to fund. Below them you have the associates who do the legwork, research, and due diligence. Larger firms will have more layers of hierarchy.

Venture capital firms are typically divided into two types: independent and corporate. Examples of top independent VCs include Sequoia Capital and Andreessen Horowitz. They invest purely based on the market potential of the startup.

Typical corporate VCs include Google Ventures and Intel Capital, which are subsidiaries of their respective companies. Beyond market potential, corporate VCs typically invest in startups that could serve a strategic purpose for the mothership.

Sometimes, the corporations will get involved in VC investing without forming a separate organization. Alibaba and Softbank are examples.

While some startup founders desire investors with entrepreneurial experience, it’s not a prerequisite for success. Plenty of venture capitalists on Forbes’ Midas List are not entrepreneurs. They include: Peter Fenton of Benchmark, Chris Sacca of Lowercase Capital, and Jenny Lee of GGV.

Venture capital trends

The United States VC industry on average underperformed (PDF link) compared to stock indices like NASDAQ. This means only the top-tier venture capitalists are making enough returns to justify the investment by LPs. That said, venture capital often only forms a tiny portion of an institutional investor’s portfolio.

The US VC industry is the largest in the world, in large part due to Silicon Valley. US$58.8 billion in VC investments were made in the country in 2015. China is second in the world at US$41.8 billion, followed by India in distant third at US$7.9 billion.

Here’s an infographic on the state of venture capital in Asia:

This post was originally published on: techinasia.