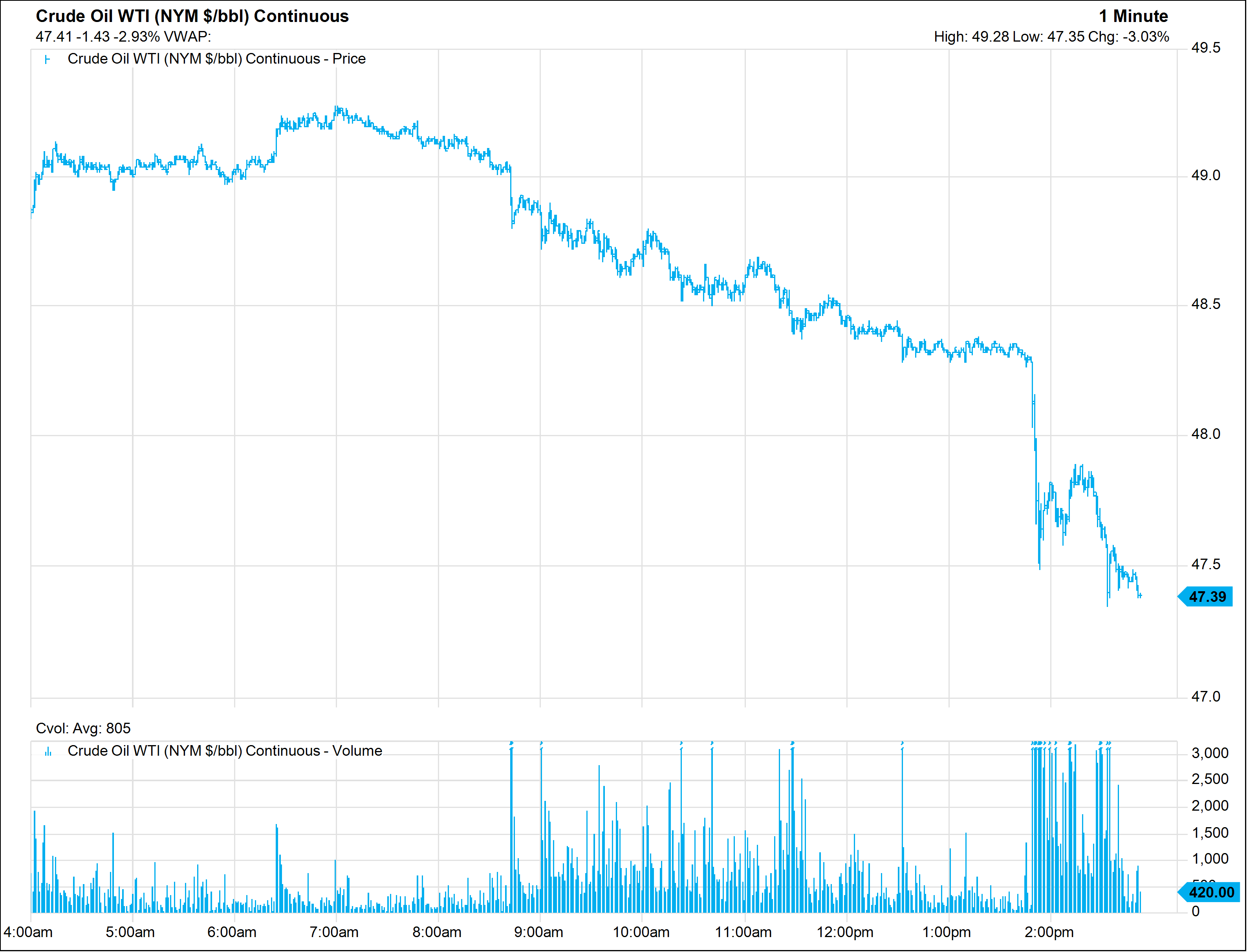

After a momentary increase as news of lower Russian production major OPEC exporters hit the market on Tuesday, Oil prices sharply extended losses just before Tuesday’s settlement. The U.S. crude is breaking below $48 a barrel for the first time in more than a month.

OPEC & other producers including Russia have agreed to cut output by 1.8 million bpd for first half of 2017. OPEC and other producers plan to meet on May 25 for long term strategy discussion. The key agenda for discussion hovers controlled crude oil output to stabilize oil price.

Libya continues to increase oil output

The restart of two Libyan oilfields had resulted in a one-month low of $50.45 last week in the future contracts. Benchmark Brent crude oil LCOc1 was up 50 cents at $52.02 a barrel. U.S. light crude CLc1 was up 35 cents at $49.19.

Libya’s National Oil Company said on Monday, production had risen above 760,000 bpd to its highest since December 2014. There are also plans to continue boosting oil production till the end of the year.

Outlook for investors

Andy Lipow, president of Lipow Oil Associates.

“The interpretation would be that Libyan production and exports would be increasing in the next couple of months, adding to supplies in an already oversupplied market.”

British Petroleum CFO Brian Gilvary told a news agency in recent interview that things are beginning to stabilize for investors. Oil inventories would keep falling & prices would be supported above $50 if OPEC extended its output limits.

The oil market sentiment however remains fragile. The investors are still concerned with global stockpiles which remain at record high numbers.

OPEC-led deal to curb the global glut in supply is being challenged by increased output from USA and Libya. The increased supply is ensuring that the market remains volatile.

Tim Evans, energy analyst at Citi Futures, has highlighted that the recovery in Libyan oil production also weighs on sentiment. He said:

“Like the recovery in U.S. shale oil production, any sustained recovery in Libyan and/or Nigerian production limits the impact of the OPEC-led production cuts.”

According to calculations by experts, U.S. crude oil inventory is supposed to close approximately 10% above the year-end reserve levels. The inventories continue to decline after the record high of March for the fourth consecutive week.

Further decision about extension of production cuts beyond June shall be announced at next OPEC talks on May 25, 2017.