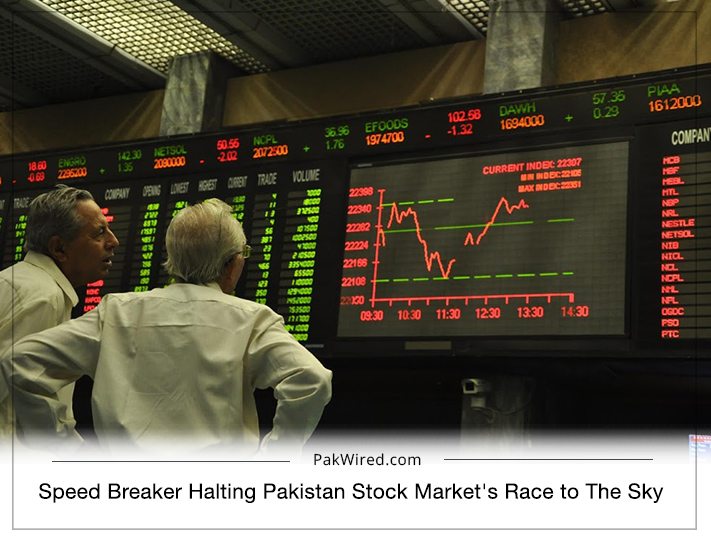

Lately, the stock market of Pakistan has seen some glorious upsurge. Since 2009, the Pakistan Stock Exchange (PSX) – Pakistan’s unified market index – has witnessed a whopping increase of 400%. Additionally, Pakistan’s stock market has left the neighboring countries including China and India behind as KSE gained 40% in 2016. Even today, a quick search of Stock Market news from Pakistan is bound to fill up your screen with all the good vibes. The bull is raging.

Chief Facilitators in Pakistan’s Stock Market Improvement

There have been plenty of factors that have come in handy for Pakistan, which eventually helped in the expansion of the stock market. Some of the dynamics got shaped by the refined macroeconomic environment, increased economic development and substantial decline in inflation and interest rates.

In 2016 alone, Pakistan’s economy increased close to 6% which is 4.8% more than it was in 2015. Moreover, the inflation rate declined by 4% in 2016 as compared to 10% in 2012. In addition, the 10 year Treasury bond produced 8% in 2016 as compared to 12.5% four years ago.

Apart from the aforementioned factors, another key element that boosted Pakistan’s stock market has been the foreign endorsements for Pakistan’s market reforms. The country got a monetary assistance from World Bank worth $1 billion. Furthermore, there have been few domestic acquisitions from overseas companies like Shanghai Electric Power Co acquired some of Karachi’s K-Electric stakes. Another major foreign endorsement has been the addition of Pakistan’s market into MSCI’s emerging market index. The recent most addition to this line of achievements has been PSX’s shares acquisition by the Chinese market.

So, Where Is The Speed Breaker Halting Pakistan Stock Market’s Race to The Sky?

Usually three factors play an active role in dulling budding and frontier markets. They are:

Corruption,

Inflation, and

Revolution.

However, the order of these elements can be different. These factors have been taken in account since South Asian and Latin American countries have experienced these traits before. Moreover, their stock markets were suffered largely due to the aforementioned reasons.

As far as Pakistan is concerned, the low inflation rate is difficult to maintain consistently. The core reason is fragile infrastructure that generally plays a vital role in higher prices of basic commodities. Another reason is that Pakistan is massively dependent on imported oil which has almost doubled since January 2015.

Corruption in Pakistan is a problem of monstrous proportions. Moreover, the appointment of friends and relatives in key positions of authority also play a vital role in diminishing stock market. Cronyism generally leads to government budget and current account deficits. It also haunts technological progress and there is hardly any competition. Despite progressing in last few years, Pakistan is still ranked up on Transparency International’s Corruption Index.

When a country is deprived of unjust justice, large income inequalities and weak infrastructure then a revolution can take place. Pakistan’s relation with India is highly disputed for number of reasons. Another concern over the stock market of Pakistan is the higher US interest rates. As a consequent effect, it makes investment in the budding and frontier markets less appealing.

These are some of the factors which might tempt foreign investors not to investing in Pakistan’s stock market, and put a reign on the upward movement of the market. What are your thoughts?

Source: Forbes | PHOTO: PPI