ATM skimmers divest banks the world billions of dollars each year, not to mention causing thousands of people like you a massive headache. With incidences of debit card skimming on the rise, it’s imperative that you protect yourself by learning more about how card skimming works and how to protect yourself from it.

What is an ATM Skimmer?

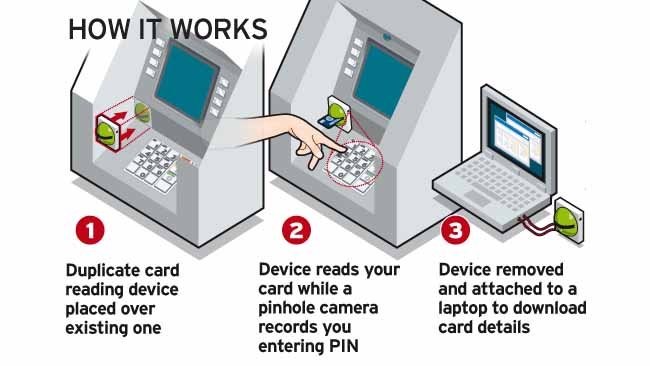

An ATM skimmer is an electronic machine that is illegally attached to ATMs, usually by tampering with it physically, without the owner’s knowledge. ATM skimmers are capable of recording the details of your card when you swipe it. ATM skimmers, when attached to ATMs, are paired with cameras. The camera records your PIN number when you enter it into the machine, while the skimmer will store your card info.

The skimmer itself is placed alongside the magnetic reader that is a part of the ATM machine. When you slide your card through the ATM, you also unwittingly slide it through the skimmer, which promptly stores your card details. The camera, on the other hand, can be placed anywhere it gets a clear shot of the keypad.

Some skimmers will be paired with fake keypads instead of cameras. These keypads are capable of recording your keystrokes and, so, your PIN number too.

How Do You Protect Your Card from Skimmers?

If you take a few basic precautions when using your card, you won’t fall prey to theft. Here are some tips on how you can protect your card from skimmers:

Only Use Trustworthy ATMs

ATMs that are in isolated areas are more likely to be tampered with than ATMs in crowded areas, or ATMs attached to a bank. If at all possible, use the same ATM each time you withdraw cash. Of course, this doesn’t work when you’re traveling, which brings us to the next tip.

Keep an Eye Out for Signs of Tampering

Before swiping, take a good look at the machine. Does it look like it has been tampered with? Are there any suspicious dents or bulges near the card reader? Is the keypad a different color than the rest of the machine? Is a pinhole camera placed above the keypad, or do you see suspicious hole in the wall behind you?

Frequently Change Your PIN

Change your PIN regularly. Even if they get hold of your card details, they can’t use it without the PIN.

Get Text Alerts

Sign up for text alerts with your bank, if your bank offers that service. When you withdraw money from your bank, you will get an alert on your phone. You will know immediately if money gets withdrawn from your account by someone else.

Check Your Bank Statements

Also check your card statement every month, and watch for suspicious expenses you don’t remember. Some thieves will cleverly withdraw a small sum from your card each month, instead of a lump amount.

Don’t Let Your Card Out of Your Sight

And, as a final tip, don’t let your card out of your sight. When shopping at a store, watch the store clerk as he swipes your card. Make sure he doesn’t swipe it through 2 machines instead of one.

If you suspect you’re a victim of card skimming, we recommend you contact your bank or card provider immediately. Generally, if you are prompt, you won’t lose any money, though that will depend on the country you are in, its laws and your bank.