If there’s ever been a time to reconsider ad budgets, and revisiting advertising strategies, it is Now. As per a recent research, optimizing digital strategies is the new survival instinct for the marketers.

With the meteoric rise of digital media, it’s been no secret that advertisers have been shifting away from the traditional fronts to the newer grounds of digital domain. However, as eMarketer observed in its recent study, in a first of its nature, money is being funneled towards digital advertising at the expense of Television advertising. Digital platforms are eating up business at a rate faster than anticipated.

Let us figure out in the following passages, how does the changing digital advertising landscape work for the marketers.

I – It is TV Versus Mobile Eventually

“TV global growth is diminishing. In most major developed markets, TV growth is slowing and in some cases stagnating.”

The New York Times quoted Vincent Letang, the head of global forecasting at Magna Global.

A recent study released by eMarketer gives insight into the new paradigm for the TV industry that threatens the viability of the old model: 2016 TV ad spending will be $71.29 billion with digital coming in at $72.09 billion.

This implies that digital will represent 36.8% of US total media ad spending, while TV will represent 36.4%.

It’d be interesting to note that digital ad spending has already surpassed traditional TV in many Western European countries and in China, with the U.S. only catching up now.

The paradigm shift in the ad spending across media is a powerful symbol of the future of advertising.

This strong performance of the digital ad market has primarily been influenced by the choice of device, which in this case happens to be mobile. Projected mobile ad spending will account for a growth of 45.0% making it $45.95 billion this year, and that by 2019 it will cover one-third of total ad costs in the U.S.

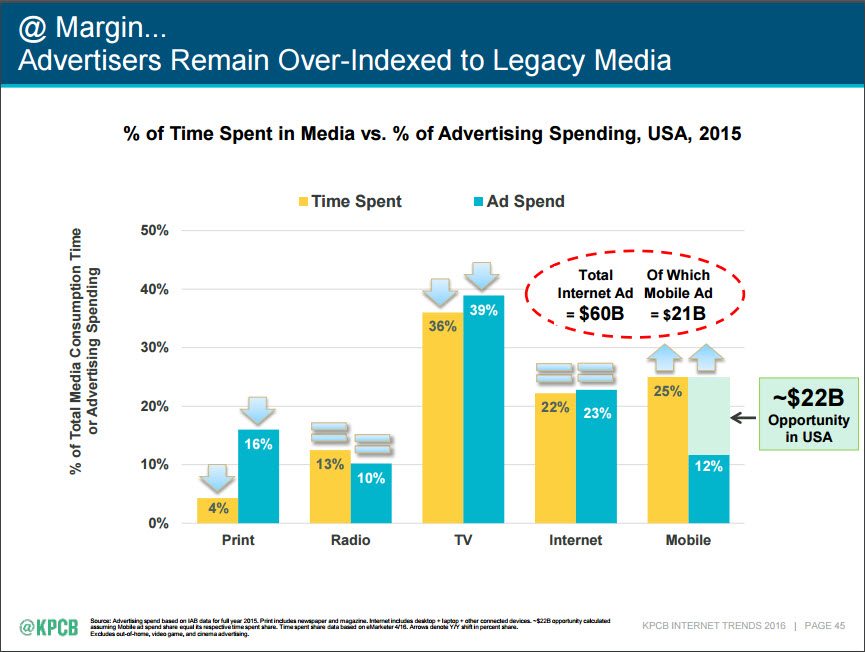

In her 16th annual State of the Internet presentation, Internet analyst Mary Meeker predicted that mobile advertising to be a $22 billion opportunity for marketers. Meeker compared time spent on media and the advertising spend in each category to deduce her predictions.

This paradigm shift in the ad spending across media is a powerful symbol of the future of advertising, which happens to be a mobile device.

That shift in ad dollars to the digital frontiers of online & mobile has led to what Mr. Letang of Magna Global calls “digital deflation”: those ads are typically cheaper, and as ad dollars move to digital, pressure is building on media sellers to cut their ad prices. Consequently, growth in the overall ad spending market is slowing.

In order to help you optimize your mobile marketing strategy, here’s an article where we help you develop a sustainable mobile engagement with your consumers.

II – Display & Search Are The Key Formats

With $34.56 billion, 48% of the total digital ad spending is being consumed in display ads. The size of the spending makes it obvious that advertising on social media platforms grabs the spotlight when it comes to where advertisers spend their dollars

The display ads category consists of formats comprising of banners, Facebook’s news feed ads & Twitter’s promoted tweets, video, rich media, and sponsorships.

Google’s ability to equip marketers to zero in a massive worldwide audience is where the search ad spend finds its roots. Unlike TV ad spend, Search spending isn’t going anywhere.

While the sun isn’t going to ever set over internet searches, Display is predicted to be the top format for digital ad spending through 2020.

III – Facebook Dominates in Digital Space

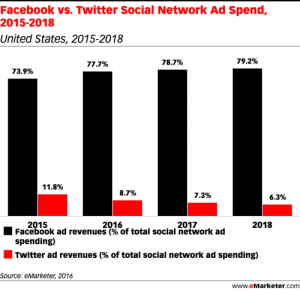

Based on the data from Content Marketing Institute, Facebook has a 66% effectiveness rating for B2C social media platforms, Twitter came in third place (behind YouTube) with a 30% effectiveness rating.

In its 2016 Social Media Marketing Industry Report, SocialMedia Examiner collected data from more than 5000 marketers and made the following conclusions:

Facebook is the most important social network for marketers by a long shot! When asked to select their most important platform, 55% of marketers chose Facebook, followed by LinkedIn at 18%. Plus, 67% of marketers plan on increasing their Facebook marketing activities.

A surprising 86% of social marketers regularly use Facebook ads, while only 18% use Twitter ads.

67% of respondents plan to increase their marketing activities on Facebook.

EMarketer reports that Facebook alone accounted for 16.6% of all digital ad spend compared with Google’s 13.8%.

When it comes to define social media advertising strategy, Facebook is the ultimate giant consuming the major share of digital advertising budgets across the globe.

IV – Brand Stories Focus at Videos

The focus of the industry on viewability, native and better measurement is driving more dollars and delivering better results.

eMarketer quoted its forecasting analyst Martín Utreras.

In the Q2 2016 financial report, Mark Zuckerberg, Facebook founder & CEO declared:

“We’re particularly pleased with our progress in video as we move towards a world where video is at the heart of all our services.”

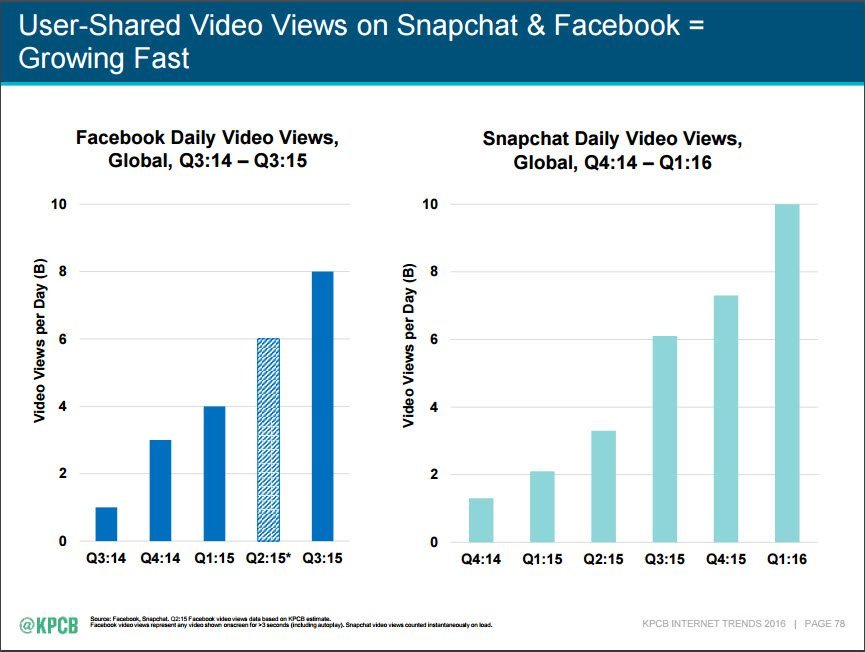

From Meeker’s State of the Internet analysis, it is evident that newer and more gen Z video platform Snapchat too, can not compare with the visual content consumption as is experienced at Facebook.

As the statistical projection over data shows, not only the video ad spending is going to keep growing by double-digit percentages, it is going to have a greater share of total digital spending as well. 2016 sees video ad spending reach $10.30 billion, representing 14.3% of total digital spending. This figure shall climb to 15.1% by next year.

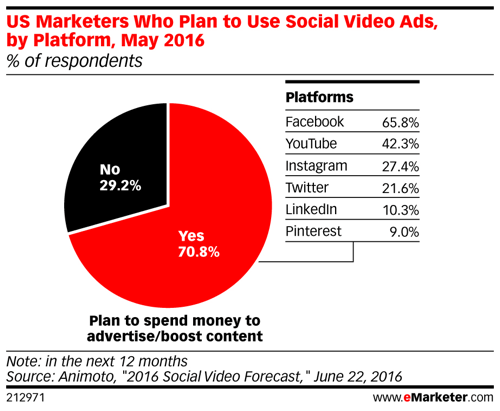

eMarketer report suggests that nearly 66% of marketers plan to use Facebook for their video social marketing, while just over 42% plan on using YouTube. SocialMedia Examiner’s 2016 Social Media Marketing Industry Report confirms that the use of video is a key part of most marketers’ plans in 2016, with 73% planning on increasing their use of videos and 50% plan on utilizing live video services such as Facebook Live and Periscope in the next year.

Digital is on its way to become the Sovereign in terms of advertising dollars spent, which indicates the significant shift in how we consume content. This shift is unmapped territory for the U.S. Television market.