In an internal exercise Federal Board of Revenue (FBR) has identified that almost 22,000 big taxpayers and 100,000 rich individuals have not filed their tax returns during 2016. These individuals and companies had filed their tax returns in the previous years. The break-up of the 22,000 absconding big taxpayers shows that over 7,700 companies and 14,000 individuals have not filed their current tax returns.

FBR Internal Tax Exercise

In order to improve as a department, FBR has been working on improving internal processes. One of the processes that have been recently added is the year-on-year comparison of tax filers. The process involves doing a systematic audit of all tax-return filers and compares them year-on-year. The results of the activity help FBR to see if companies who have filed tax-returns in the past are continuing to do so.

Also Read: FBR To Publish Directories To Disgrace Non-Filers

Monetary impact of non-filers

In the financial year 2014 and 2015 – the companies now missing had paid income tax of Rs10 and Rs11 billions, respectively. In the financial year of 2016, none of these companies and individuals had filed their tax returns.

Panama Corruption Scandal impact?

Certain analysts have been saying that the “tax revolt” from big taxpayers can be the aftermath of Panama Corruption scandal. The statement however appears to be based on hypothesis that is yet to be proved. FBR officials say that they are on hot pursuit of the missing companies and will be able to provide a more concrete answer. The timeline for concrete answers from FBR is yet to be provided.

Dawn has quoted an unnamed official source in FBR stating:

“we have asked the field formation to strictly enforce the filing of returns and recovery of revenue from these big taxpayers.”

How Does FBR Compete Globally in Terms of Tax Collection?

According to the official statistics, FBR has a tax net consisting of 1.2 million people who filed tax returns for 2016-17. This accounts for less than 1% of the population of the country. Put in context, the ratio of tax return filers in Canada is around 80% of the population.

Also Read: Pakistanis Shifting to Hard Cash Transactions to Evade Taxes

Breakup of Missing Big Taxpayers

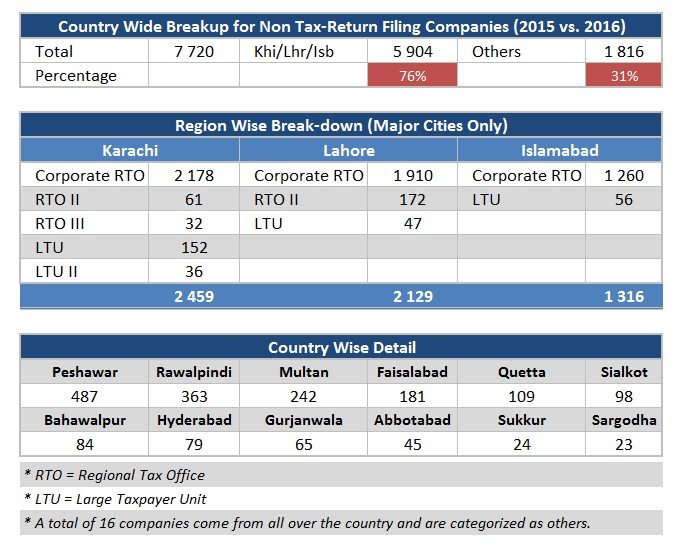

The 22,000 big taxpayers include 7,720 companies and 14,103 associations of persons (AoPs). The missing companies break down can be seen as.

The missing associations of persons follow the same pattern and highlights increase in mistrust in FBR procedures. FBR officials, however, state that they are willing to make the necessary changes to fix loopholes in their system.