We often hear the term Foreign Direct Investment (FDI) in Pakistani news and analysis shows. It’s typically used as an indicator to show how successful (or not) a government is. Low FDI is normally seen as low trust levels abroad which equates to less investment, but what exactly is Foreign Direct Investment?

What is Foreign Direct Investment

FDI is an investment made by an entity (company or individual) in one country into a business in another country. It must be noted that FDIs are different from portfolio investments because the former will be an investment into a controlling share of a foreign business or acquirement of foreign business assets in comparison to just investment into equities which is the case in portfolio investments.

Types of Foreign Direct Investment

FDIs normally fall under horizontal, vertical, or conglomerate categories. Horizontal direct investments are where a company establishes/acquires the same business abroad as they operate at home. Vertical direct investments are where the company would establish/acquire a business that is different to the business at home but still related to the industry. Lastly, conglomerate direct investments are where the company invests in a business unrelated to the business at home.

FDI in Pakistan 2018 – 2019 Snapshot

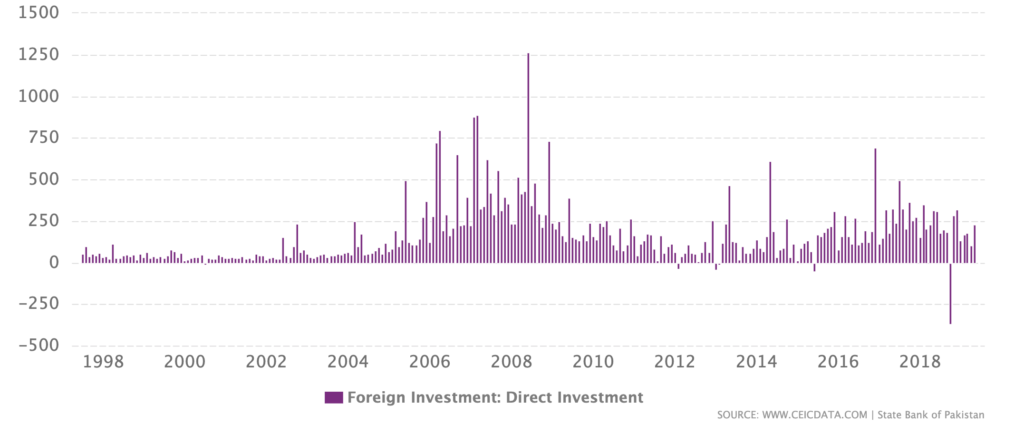

The latest data available through the SBP shows information till May 2019.

What we see is reduction of around 40 per cent in July 18 from the previous two months which holds for 3 months before a sharp fall to -$367 million. This is the lowest figure seen in from the the data available which starts in July 1997. November and December can be seen clawing back to similar amounts as prior to July 18 before dipping around the $150 million mark again.

FDI in Pakistan – 5 Year Snapshot

Looking at the 5 year data, we see that the lower figures ($130 – $170 million) from the 1 year snapshot are in fact average where as the figures around the $300 million mark are not as common. Another interesting month was December 2016 where Pakistan saw its highest FDI at $692 million – the second highest in the data available, with June 2008 being the highest at $1262 million.

FDI in Pakistan – Historical

Analysing the historic data (July 1997 onwards), we see that from 2016 to date, we are starting to see the positive cluster that was seen in the period between late 2005 and 2011.

Do FDIs Benefit Nations?

A detailed study on FDI affect on developing countries like Pakistan is by K.M. Wacker in 2011, entitled ‘The Impact of Foreign Direct Investment on Developing Countries’ Terms of Trade’ finds that:

‘FDI has a long-run impact on NBTT whereas FDI flows (or, equivalently, stocks calculated using high depreciation rates) do not seem to matter for NBTT, entails that developing countries should strive for a longterm partnership with foreign direct investors that have a long-lasting interest in the host economy. Volatile investments, on the other hand, do not seem to provide a good basis to improve export performance. This means that the strategy to attract FDI should clearly be imbedded into a national development perspective that provides macroeconomic stability…‘

*NBTT = Net Barter Terms of Trade

Though the paper focuses a lot on the effect on trade, it theorizes a good indication as to the results of FDIs in the long term, whilst also warning that there it should be used as one of many strata in the economic development policy.