Pakistan Automobile Market continues to show growth in 2016-17 in comparison to 2015-16. In data released by the Pakistan Automotive Manufacturers Association (PAMA) on Thursday, it has been shared that the total car sales – by the local manufacturers and assemblers, have reached at a 155,960 units mark. This sales count is 2.39% more in the current fiscal year as compared to 152,229 units sold in the same period last year.

We have carried out a detailed analysis on the automobile industry based on the data provided by PAMA. PAMA is responsible for maintaining historical and current data for Pakistani market.

Also Read: Automobile Sales – 1.69% Rise in First Three Quarters of Fiscal Year 16/17

Building upon the data collected by PAMA *, this analysis caters to vehicles produced or assembled within Pakistan during the said periods.

The Car Industry – Historical Trend Mapping

The overall sales volume has increased by 3K (2%) between the comparison periods: 2015-16 and 2016-17.

Below 1000cc Category

Suzuki maintains its dominance in the automobile range below 1000cc category. The company managed to sell 75,000 units of Cultus, Wagon R, Mehran, and Bolan in the year. This is still a decline of 4,000 from the sales of these cars from last year, yet the position of the company as a leader goes unchallenged.

1300cc Category

In the market for 1300cc cars, Honda is catching up to Toyota at a quick pace. Honda has increased its market share from 29% to 49% within a year. Honda has sold almost 10,000 more units in comparison to the units sold last year. If the trend continues, we will probably see end to the monopoly of Toyota on roads in Pakistan, which would definitely lead to a better competition in the local market.

Also Read: Indus Motors Company To Invest Rs4.19 Billion For Capacity Expansions

Honda’s demand is such that despite a massive increase in production, the company still has not been able to make the production come at par with the existing demand. This indeed indicates a difficult time for Toyota, and one that has the potential to lead the company to further innovation. It is no secret that Toyota has become static in terms of innovation during the last couple of years.

The HTV Industry – Historical Trend Mapping

The HTV industry has seen a massive increase in demand due to CPEC related projects. The industry sales have almost jumped by 2,000 (42%) in terms of units.

Isuzu seems to be the biggest beneficiary of the increased demands as they have seen their sales double in one year period.

The competition between Isuzu and Hino remains strong as they continue to battle for dominance.

Also Read: List of Upcoming Cars Launches in Pakistan in 2017

The agriculture sector is also seeing a massive surge as sales have increased by 22,000 (69%) units. Both Fiat and Massey Ferguson have doubled their production to meet the increased customer demand.

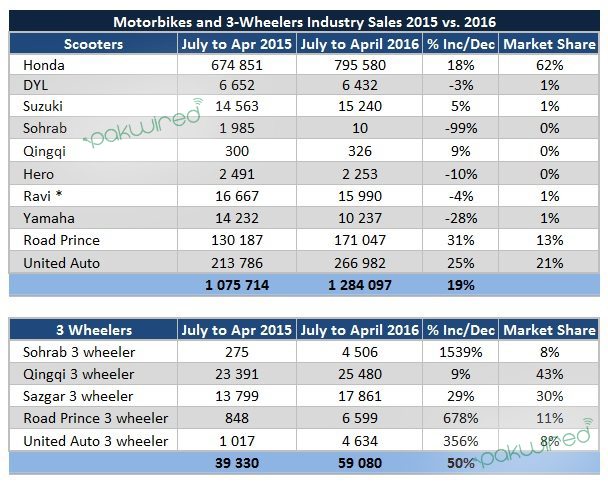

The Motorbike and Three-Wheeler Industry **

This industry has also seen great growth potential. Honda continues its monopoly in the bike market. Qingqi maintains its monopoly on the market, however new players are also making waves within the sector.

* We at PakWired do not take responsibility of any discrepancy within PAMA’s data.

** Data for Ravi Motors was unavailable for Apr 2017.